Weekly Playbook: July 7th

Delta says keep climbing. The market is. Just keep your seatbelt fastened; turbulence hits fast.

Key Takeaways This Week

Indexes hit record highs despite weak labor internals and looming tariff deadlines.

Rate cuts still expected as Fed futures price in September and December easing.

Trump’s megabill passed, setting up a wave of short-term Treasury issuance.

Tesla faces renewed political risks and potential buying opportunities as Musk’s fallout with Trump and third-party ambitions stir up fresh headline noise.

Centene’s 38.3% collapse highlights the risk of sector-wide fundamental shifts in health insurers.

Market Overview

Markets wrapped the week in record territory, brushing aside trade war noise and soft underpinnings in the labor market with all the confidence of a poker player holding seven-deuce. The S&P 500, Nasdaq, and Dow added 1.72%, 1.62%, and 2.3% respectively, fueled by better-than-expected headline job growth and an increasingly forgiving view on macro risks, even if much of the “good news” has more smoke than substance.

June’s jobs report gave bulls just enough fodder, with a 147K print that beat forecasts. But once you scratch the surface, the picture dims. Private payrolls grew only 74K, aggregate work hours shrank, and participation among older workers hit a two-decade low. That didn’t stop markets from rallying or Fed futures from continuing to price in rate cuts for September and December. Ironically, the biggest disinflationary force right now may be demographics, not Fed policy.

Still, earnings optimism is holding the line. Analysts have been steadily revising S&P 500 EPS higher, and that’s become the central anchor for this momentum-driven tape. With Q2 reporting season kicking off in a couple weeks, all eyes shift to margins and tariff pass-through. Why? Because those newly reinstated tariffs, on pace to rake in $400B annually, have been oddly invisible in both CPI data and earnings commentary. Someone’s eating the cost, and earnings calls may tell us who.

Geopolitically, President Trump’s July 9 tariff deadline is the big wildcard. So far, deals with Vietnam and India are trickling in, preliminary, limited in scope, and mostly symbolic. The Vietnam agreement, which cuts tariff rates on rerouted Chinese goods to 20% from 46%, is less about diplomacy and more about plugging transshipment loopholes. With Japan getting labeled “spoiled” and China still facing 55% tariffs, the potential for another escalation remains high. Yet the market seems confident the administration will settle for optics over outcomes.

Meanwhile, bond markets are bracing for impact after Trump’s “megabill” passed through Congress and was signed into law. The plan includes sweeping tax cuts and spending measures projected to drive a $3.4 trillion deficit increase through 2034. To fund it, the Treasury is expected to flood the market with short-term bills, pushing the T-bill share of total marketable debt toward 25%. While yields have already climbed above 4%, appetite from money markets and cash-heavy funds remains strong. Still, reliance on short-dated paper creates interest rate risk if inflation surprises or liquidity dries up. It’s a financing strategy that may save on yield curve costs today but could get painful if policy shifts or global cash demand softens.

At the same time, trading volumes are hitting historic highs. Global equity turnover reached $6.6 trillion in the first half of 2025, driven by both institutional repositioning and a retail crowd that refuses to flinch. Retail investors accounted for nearly a quarter of market activity and net bought over $137 billion in U.S. equities and ETFs—even as volatility, tariffs, and Middle East tensions mounted. Nvidia, Tesla, Palantir, and the usual ETF suspects ($SPY, $QQQ) dominated the leaderboard. Some call it “American exceptionalism,” others call it stubborn dip-buying, but either way, it’s working: the average retail portfolio is up over 6% year-to-date.

The financial sector was a standout last week, with regional banks and large caps catching a bid on lighter regulatory expectations, dividend hikes, and renewed M&A chatter. The Fed’s stress test results paved the way for major institutions to announce sizable capital return plans, while hopes for rollback of post-crisis rules lifted sentiment across the board. Regional lenders, still recovering from last year’s deposit flight concerns, also saw renewed interest as investors rotate into value and yield. Preferreds and financial ETFs like $XLF gained ground, reflecting broad-based optimism that the worst may be behind. There’s still sensitivity to duration and CRE exposure, but for now, the sector is benefiting from a favorable policy and earnings setup.

Structurally, a brewing fight in the plumbing of the markets deserves more attention. IntelligentCross, a dark pool turned rising star, is challenging exchanges by asking the SEC for protected quote status. If granted, brokers would be forced to route orders there when it posts the best price. Its delayed matching engine and use of “private rooms” for selective counterparties has drawn heavy fire from Citadel, Nasdaq, and market structure purists. Whether this is the future of execution or just regulatory arbitrage in a shiny wrapper is up for debate, but either way, it’s rattling some powerful cages.

The broader takeaway? This market continues to thrive on hope and headline management. Earnings sentiment is strong, policy expectations remain dovish, and geopolitical risk is being repriced with striking generosity. But there’s fragility beneath the surface, visible in labor market cracks, structural distortions, and the fact that real inflation-adjusted growth is looking increasingly scarce. As the July 9 tariff clock ticks and earnings season begins, investors may soon be reminded that sentiment rallies only last as long as earnings deliver.

For more details, visit Barron’s.

My recent listen to The Compound and Friends Ep. 198 offered a timely look at where markets are—and where the next leg of leadership may come from. The general view that we’re still in a multi-year AI-led bull market aligns with what I’m seeing: strong internals, breakout breadth, and institutions finally stepping back in. It’s not euphoric, and that’s what makes it convincing.

What stood out was the shift in focus from AI infrastructure to the software and services layer. It’s less about the chips now and more about which companies can scale real-world use cases. Valuation metrics are evolving too; it's less about traditional multiples and more about margin-growth combos that actually capture operating leverage.

The discussion around legacy tech and stagnating innovation hit a chord. Some names just aren’t built for the next wave. Others are doubling down—whether through CapEx, product risk, or vertical integration. That’s where I’m looking.

Watch it here.

On Tesla, while the long-term robotics and autonomy thesis is intriguing, recent political moves add near-term uncertainty. Musk’s fallout with Trump and the announcement of the 'America Party' add a fresh layer of headline risk, especially with vague promises of midterm influence and potential government contract blowback. If that weighs on the stock or inflates IV, I’d be happy selling cash-secured puts I’ve highlighted in my quarterly options writeup.

Earnings Recap

Centene ($CNC)

While it didn’t report earnings in the usual sense, pulling guidance is often more telling than any headline number and usually signals serious trouble. The first key support near $44 was taken out in after-hours, then briefly backtested at the ECN open. Once the $40 level broke, the combination of technical failure and a large NYSE opening imbalance triggered heavy selling as investors rushed for the exit. The stock closed the week down 38.3% and may find some footing in the low $30s, where multiple horizontal levels and a long-term POC align, but recoveries after this kind of washout tend to be slow.

It’s also a reminder to the bottom-fishing crowd in names like $UNH and $OSCR: when fundamentals shift across an entire sector, you often get a second bottom as part of the “buy one, get one free” promotion, no coupon required.

Here is our quick take from a fundamental perspective:

Key Index Charts

$SPY: The S&P 500 ETF gained 1.70% this week, closing right at its previous resistance level after trying to flip the big weekly trendline. The next resistance area is around $641, where a couple of measured moves converge, though a pullback may start any day due to overall overbought conditions. New support shifts to $617.

$QQQ: The Nasdaq 100 ETF rose 1.48% this week. Key resistance around $560.5 is still there to be tested and could be reactive, though the higher band of the area goes up to $565. Support stays the same at $539.

$IWM: The Russell 2000 ETF gained 3.53% this week, closing above the key $222 level. Watch for the next resistance around $230 if the breakout is confirmed. The new support is at $216, right at the 200-day moving average.

The Dow Jones ETF added 2.30% this week. It didn’t even notice the weekly trendline near $442 and ripped higher above another descending trendline from recent highs. If it takes out the all-time high at $451.5, the next stop might be around the $458 area.

$TLT: The bond ETF slipped 0.48% this week. Still rangebound, with both previous support at $85 and resistance at $89.5 unchallenged.

$BTC: Bitcoin was flat this week, still consolidating and pulling in new buyers hoping for a breakout above the previous all-time high at $112,000. It still looks positioned for another leg up, but if it gets too crowded, watch out as previous dips below $100,000 triggered massive liquidations of leveraged to-be-millionaires. Support remains at $96,500.

$ETH: Ethereum gained 2.65% this week. It’s trying to reclaim the 200-day, though $2,770 is worth watching as a potential right shoulder. The relative weakness to Bitcoin remains clear. New support shifts to $2,200, and it better hold.

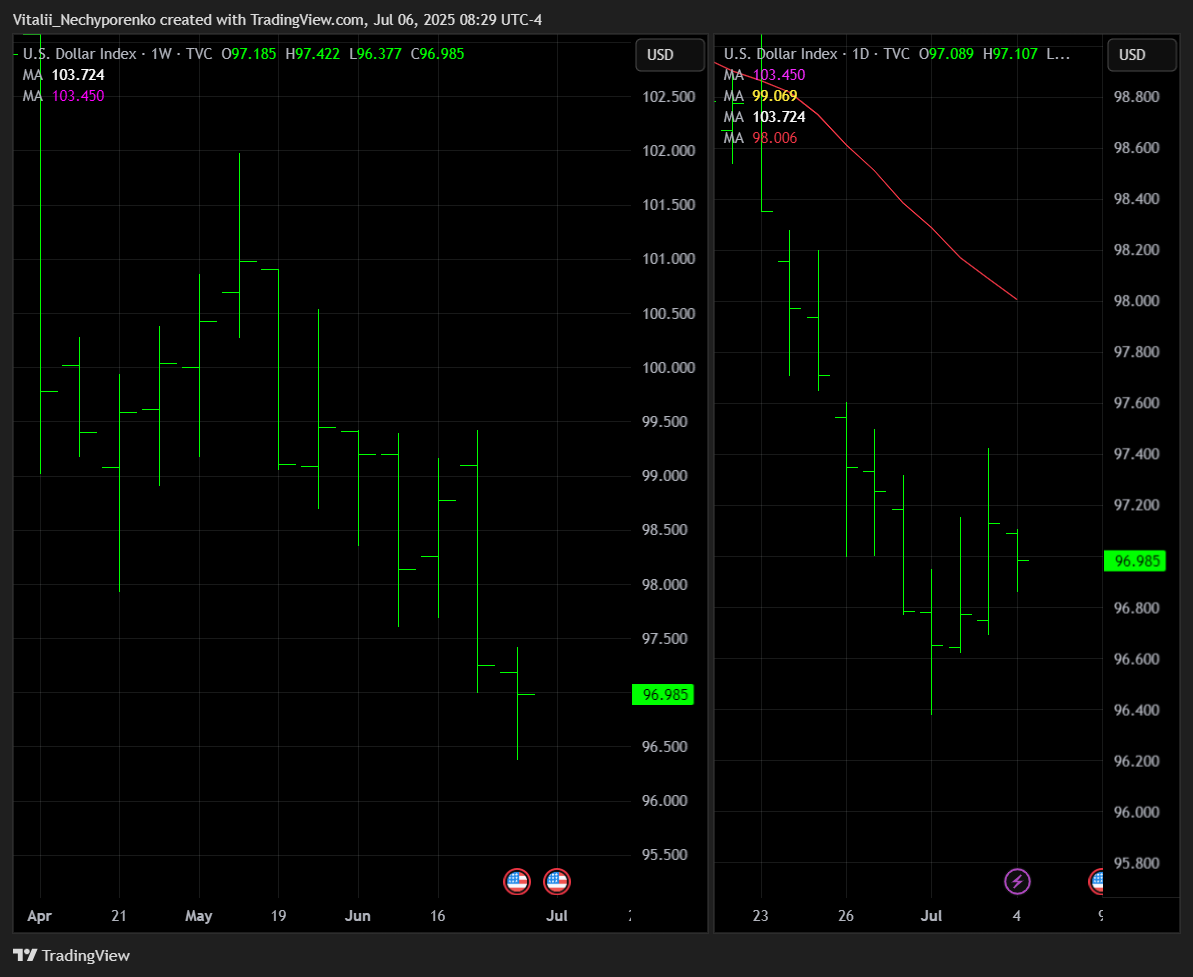

$DXY: The US Dollar Index declined by 0.26% this week. It bounced off the key $96.50 area, though the bigger picture didn’t change at all. While another fake move lower could ignite some reaction from the area, the next support in the form of a measured move stands at $95. Key resistance shifts lower to $99.5.

$EUR: The Euro gained 0.51% this week against the Dollar. It reacted nicely to the 1.181 key area, which is still to be challenged, with next resistance at 1.191 where a couple of measured moves converge. New support shifts to 1.158.

Key Earnings to Watch This Week

Thursday

Delta Air Lines (DAL) Before Market Open

Turnover: $475.0 million

Support: $47.00 – $47.75 (Projected move to First Support: -6.11%)

Resistance: $53.50 – $54.25 (Projected move to First Resistance: 5.19%)

Disclaimer:

This report is intended solely for informational and educational purposes and reflects independent commentary and analysis by the author. The author is not affiliated with any company mentioned in this report and holds no positions on the board of any related entities. All opinions, analyses, and insights expressed are the author’s alone and should not be interpreted as specific investment advice, a solicitation to buy or sell securities, or an endorsement of any particular investment strategy.The information provided is derived from sources and research the author deems reliable, but its accuracy, completeness, or timeliness is not guaranteed. Readers should not rely on this report as the sole basis for any financial decisions. The author disclaims any liability to update or revise the content as new information becomes available.

Investing involves significant risks, including the potential for loss of principal. Past performance does not guarantee future results. Investments or strategies discussed may not suit every individual’s circumstances, and they may fluctuate in price or value. This report does not consider your specific financial objectives, risk tolerance, or personal investment needs. Readers are encouraged to conduct their own research and consult with a qualified financial or investment advisor before making any investment decisions.

The author and any associated entities do not guarantee specific outcomes or profits from the use of this report. The author may or may not hold open positions in the securities mentioned. By reading this report, you acknowledge the risks involved and accept the limitations of the information presented.