Weekly Playbook: December 22nd

Hells Bells are off, Jingle Bells are on. The Witches are gone, and all eyes turn to Santa

Key Takeaways This Week

Quadruple Witching is behind us with elevated volume but limited impact

Holiday shortened week ahead with thinner liquidity and fewer catalysts

Last week’s movers: NOW, LEN, MU, MDLN and NKE

There are no earnings to watch this week. All eyes on Santa

Table of Contents

Market Overview

Playbook Podcast Spotlight

Key Index Charts

Earnings & Interesting Movers Recap

1. Market Overview

Couple important updates before we dive in:

I. The Price Action Playbook: Research is now available in a new public test version, the link is embedded above

A more complete working version is expected closer to the next earnings season, though the final structure and contents may differ.

II. Fundamentals Playbook (deep dives) is discontinued. Older posts remain accessible in the archive without a paywall.

III. We are slightly behind schedule in the Market Mechanics section. The third writeup dedicated to the closing auction and the first in the opening auction series are currently in progress.

IV. Lucky Quarter Playbook: Options Overview - Q4 2025 is out with a completely revised structure. More setups, less theory. It lays out the strike selection for the upcoming quarter across the most liquid and interesting names where I will be writing CSPs, assuming the premium is there. Paywalled, but worth it.

V. I removed paywalls on previous writeups in the Lucky Quarter series so you can see what it is all about. Those cover the basics, and theory should be free.

Thanks for reading and supporting Price Action Playbook!

What was expected to be a culmination point of the year ultimately passed without delivering a decisive resolution. Quadruple Witching came and went without meaningful index level dislocations, reinforcing that the market simply never produced the kind of directional move required to turn expiration mechanics into something destabilizing.

Markets carried forward the same underlying tension seen in recent weeks, where index level performance appeared stable while leadership continued to fracture beneath the surface. Early week pressure in mega cap growth gave way to a late rebound, leaving the tape mixed and unresolved rather than trending. This was not a risk-off move, but another phase of repositioning inside an increasingly narrow leadership structure.

Information technology continued to drive both volatility and direction. Selling early on centered on AI exposed mega caps, reinforcing the idea that valuation tolerance for the trade is no longer unlimited. Headlines tied to delayed or reconsidered AI infrastructure spending added pressure and briefly raised the prospect of a broader reset. That pressure proved temporary.

The inflection arrived with Micron Technology. Earnings and guidance shifted the AI narrative away from spending fatigue and back toward supply constraints. Memory and semiconductors reversed sharply, pulling the broader growth complex higher and stabilizing the indexes into weekend. The move mattered less as a restoration of leadership and more as a reminder of how quickly sentiment can flip when positioning is crowded and liquidity is thin.

Macro inputs again played a secondary role. Jobs and inflation data were mixed but remained consistent with a cooling economy rather than a deteriorating one. Rates barely reacted, reinforcing that markets are currently far more sensitive to positioning and narrative shifts than to incremental data surprises. Policy expectations remain stable, even as confidence in where durable growth leadership should reside continues to erode.

As the calendar turns, the setup becomes more fragile. The upcoming holiday shortened week compresses liquidity further and magnifies the impact of marginal flows. With leadership already unstable and positioning still concentrated, relatively small catalysts can produce outsized moves, even when underlying fundamentals remain unchanged. Quiet tapes can persist longer than expected, but when liquidity returns, it tends to do so abruptly.

Nothing is breaking. Rotation remains constructive. However, the market is increasingly dependent on a narrow set of outcomes to stay orderly. As the year closes, the question is not whether participation broadens, but whether it can do so quickly enough to offset the fragility created as consensus trades begin to loosen their grip.

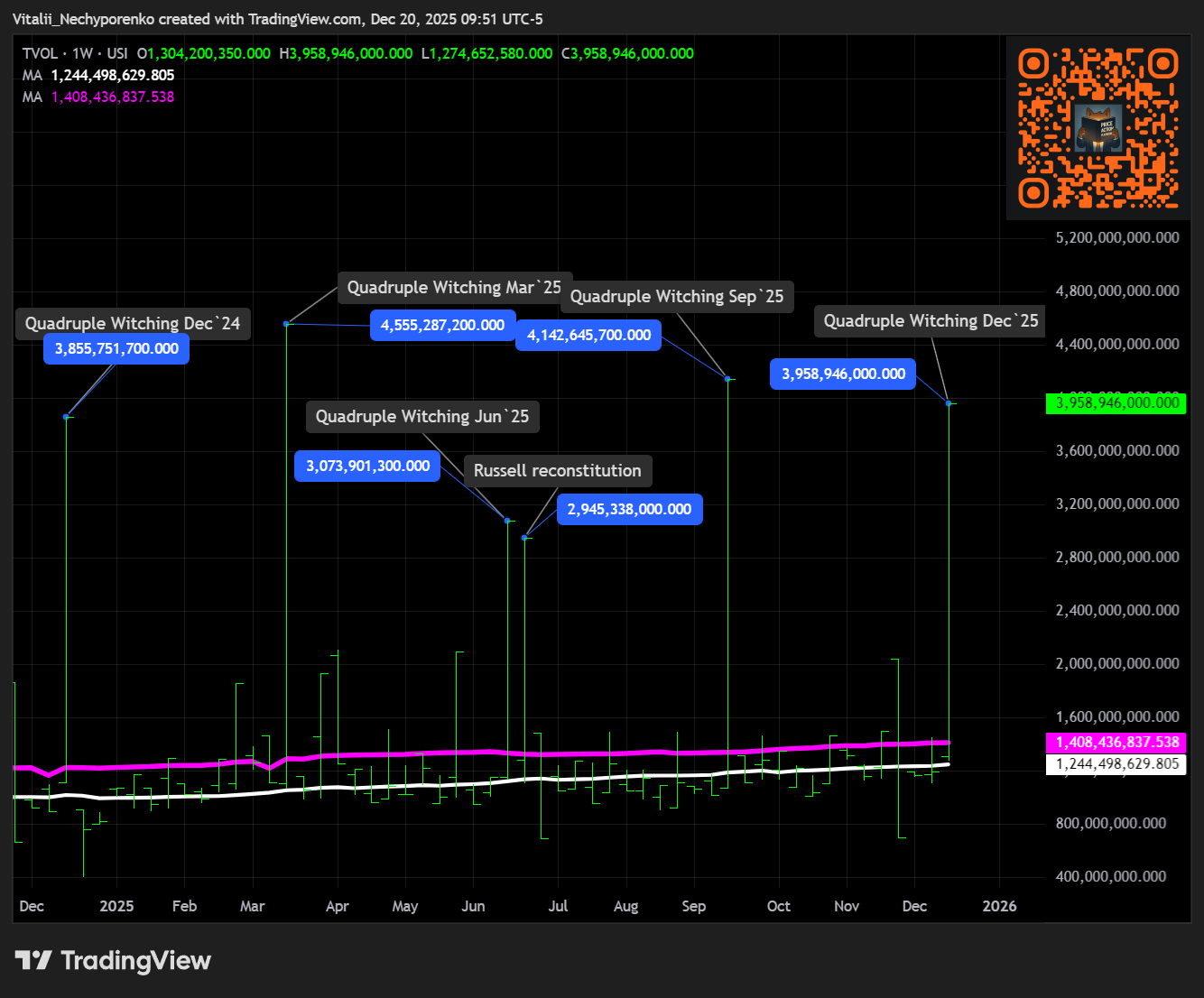

Couple thoughts on Quadruple Witching, which turns out to be called Triple since 2020, and what used to be Triple is now simply Monthly Expiration. I will stick to old school though.

As you can see on the NYSE total volume chart, it was totally fine in terms of volume traded, or at least in line with other quarterly expiration events. The critical difference was in index performance. Dislocations usually happen when there is a meaningful directional move combined with a large concentration of in the money options carrying significant notional value, creating mechanical supply or demand through hedging and unwinding.

This time markets did not do much following the latest Witching. There were plenty of moves in individual names and the closing imbalances were there, but without mechanical directional flows most of them were easily offset, leaving active speculators in the dust. This is totally fine. Dust settles and can be easily brushed off. Mechanical flows are not going anywhere. Let us see who takes the next round.

2. Playbook Podcast Spotlight

3. Key Index Charts

In this section I highlight only the most important zones with brief comments. I use fully layered charts to identify them, but keep the charts here clean for clarity.

If last week was about rotation, this one was about indecision. False breakout in gold, false breakdown in crypto, and nearly every directional push faded quickly, just look at Wednesday’s close across the indexes. Anyway, let’s go to the charts:

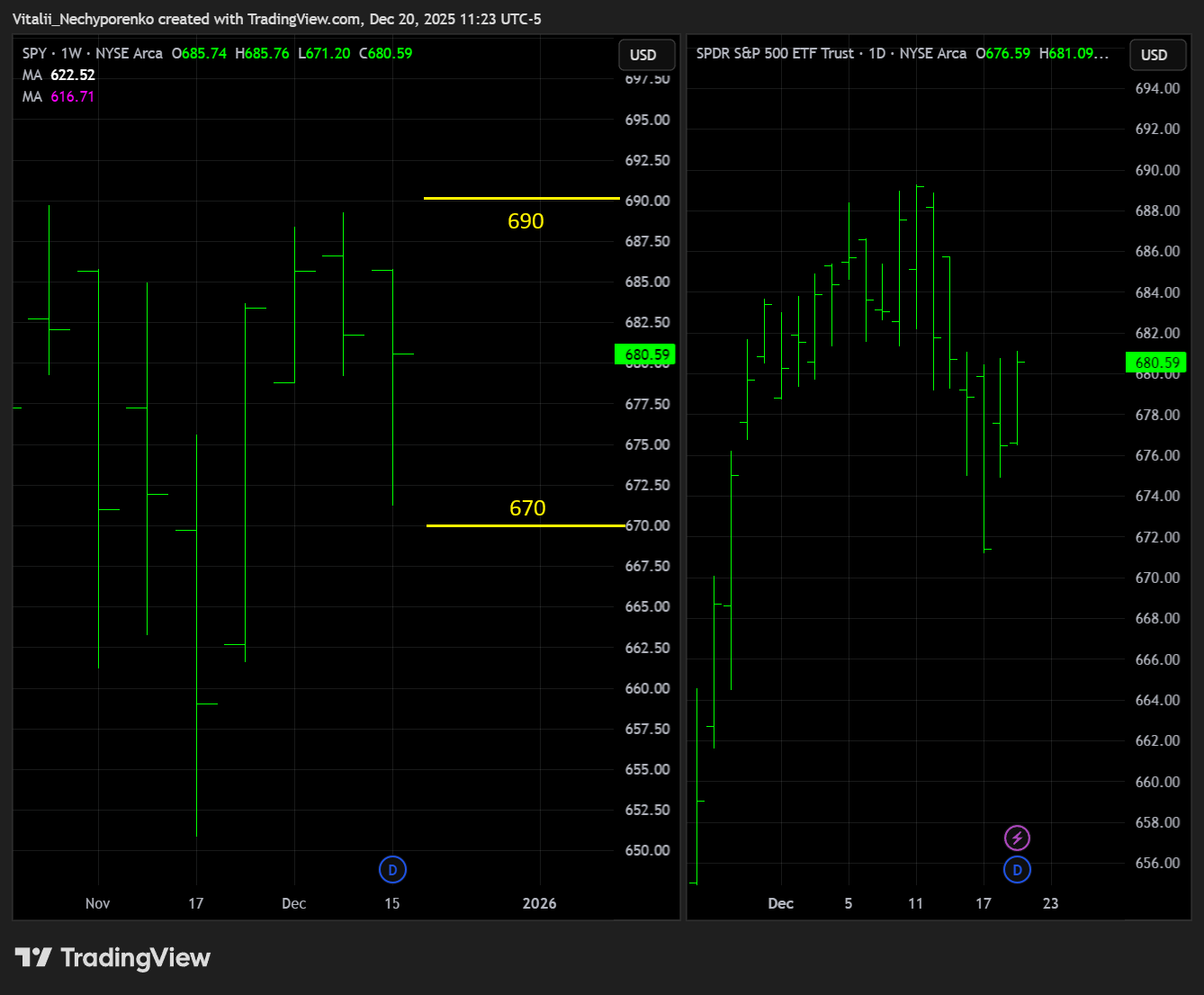

SPY

The S&P 500 ETF still looks like it wants to make another run at the ATH and lean into a Santa style move. The range continues to tighten, with key resistance now aligned near the ATH area around 690, while key support shifts to the recent pivot low near 670. There is a clear gap from Wednesday, and while gaps often get filled, they also tend to be highly reactive when price trades back into them.

QQQ

The Nasdaq 100 ETF looks slightly weaker, which is not surprising given the recent underperformance among key AI names, though that can change quickly and bulls still managed to frontrun the 598.5 key support mentioned last week. For now, key support shifts to 602, where the most recent POC lines up with the weekly UTL angle and the recent pivot low. Key resistance moves slightly lower to 632.5.

IWM

The Russell 2000 ETF showed a very controlled sellers tape, underperforming its bigger peers. The prior key resistance area near 255 remains on watch, and a rejection here would suggest another failed rotation attempt with potential downside followthrough toward the key support at 244.

TLT

The 20+ Year Treasury Bond ETF is showing a rather volatile tape around the 200 day and prior support at 87.25. Let’s see who wins here, with the bigger support and resistance areas remaining intact at 85.25 and 89.5 respectively.

BTC

Bitcoin is a good example of how quickly sentiment can flip, from “new bull run starting Monday” and “200k by year end” to at least we did not break the low, leaving Judas Priest fans unsatisfied. Key support and resistance remain unchanged at 80500 and 98500, and failed breakdowns could still lead to some kind of bounce. For now, it is a wait and see mode.

ETH

Ethereum looks a little better, back inside the structure, though it still acts as a leveraged version of Bitcoin. Key areas remain intact, with support at 2500 and resistance at 3500.

DXY

The Dollar finally showed some strength, and the test at the 97.5 key support looks delayed for now. Key resistance remains at 99.5.